Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

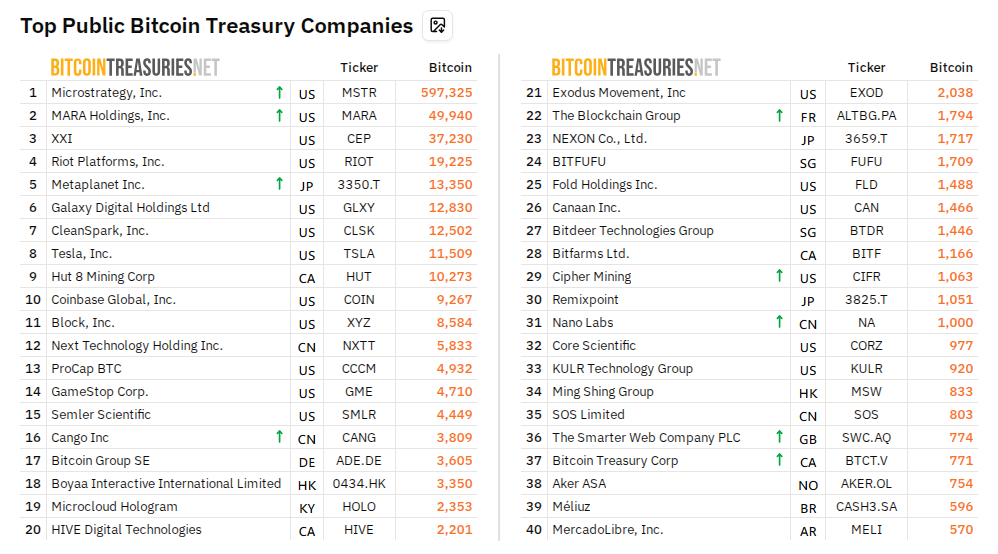

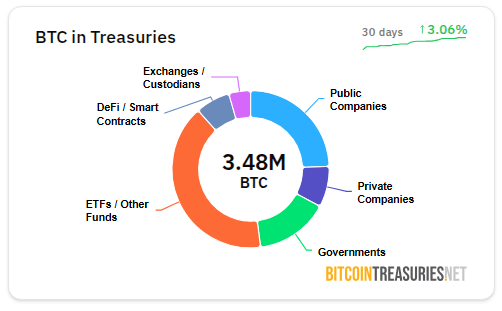

In keeping with latest knowledge, public corporations have raced forward of Bitcoin spot ETF issuers by snapping up greater than twice as a lot BTC within the first half of 2025.

Public corporations added 245,510 BTC to their steadiness sheets from January by way of June, a 375% bounce over the 51,653 BTC they purchased in the identical stretch final yr.

On the similar time, spot ETF issuers bought 118,424 BTC, leaving them nicely behind their company counterparts.

Associated Studying

Public Agency Purchases Smash ETF Buys

In keeping with knowledge from Bitcoin Treasuries, the 245,510 BTC purchased by public corporations throughout H1 2025 is greater than 4 instances the 118,424 BTC ETF issuers gathered.

That ETF element is 56% decrease than the 267,878 BTC they bought in H1 2024, regardless of the funds experiencing extra strong inflows than they skilled in the direction of the tip of 2024.

The distinction signifies more and more corporations are holding Bitcoin immediately as an alternative of counting on alternate‑traded merchandise.

Extra Firms Be part of Bitcoin Rush

Knowledge reveals 254 entities now maintain Bitcoin, and 141 of these are public corporations. That marks massive development from the beginning of the yr, when solely 67 corporations had BTC, and the tip of March, when the quantity hit 79.

These counts translate to a 140% rise in six months and a virtually 80% acquire in three months, underlining what number of new gamers have jumped in.

Technique’s Share Of Acquisition Dips

Technique (previously MicroStrategy) nonetheless leads company patrons, however its slice of the full has shrunk. In H1 2024, Technique’s buy of 37,190 BTC made up 72% of all company buys.

Within the first half of 2025, the Michael Saylor‑led firm bought 135,600 BTC however now accounts for 55% of the full—down from its earlier dominance. Corporations equivalent to Metaplanet,

GameStop and ProCap have stepped into the highlight, every including giant sums to their Bitcoin holdings.

Provide Shock May Be Coming

In keeping with trade commentary, the rise in company buying along with persevering with ETF demand might take a chew out of accessible provide.

When the subsequent halving occasion reduces new Bitcoin issuance, much less will circulate into the market. Analysts warning that growing institutional curiosity and declining provide may produce a big value response.

Associated Studying

As public corporations climb aboard and ETFs carry on shopping for—although at a decreased charge—the battle for Bitcoin is escalating. Though Technique’s investments have elevated in absolute worth, the arrival of latest patrons signifies the market is increasing.

If that development continues and reward for miners decreases following the halving, the battle for Bitcoin’s scarce provide might get fiercer.

Buyers and analysts alike will likely be paying shut consideration to how these forces affect the worth of Bitcoin within the second half of 2025.

Featured picture from StormGain, chart from TradingView