I’ve made no secret of my disdain for ESG, an over-hyped and over-sold acronym, that has been a gravy prepare for a complete host of gamers, together with fund managers, consultants and teachers. In response, I’ve been informed that the issue just isn’t with the concept of ESG, however in its measurement and software, and that impression investing is the answer to each market and society’s issues. Affect investing, after all, is investing in companies and property primarily based on the expectation of not simply incomes monetary returns, but additionally creating optimistic change in society.

It’s human nature to wish to make the world a greater place, however does impression investing have the impression that it goals to create? That’s the query that I hope to deal with on this publish. In the midst of the publish, I’ll work with two presumptions. The primary is that the issues for society that impression investing are aiming to deal with are actual, whether or not it’s local weather change, poverty or wealth inequality. The second is that impression traders have good intentions, aiming to make a optimistic distinction on this planet. I perceive that there shall be some who really feel that these presumptions are conceding an excessive amount of, however I wish to preserve my deal with the mechanics and penalties of impression investing, slightly than bask in debates about society’s issues or query investor motives.

Affect Investing: The What, The Why and the How!

Affect investments are investments made with the intent of producing advantages for society, alongside a monetary return. That generic definition just isn’t solely broad sufficient to cowl a variety of impression investing actions and motives, however has additionally been with us for the reason that starting of time. Traders and enterprise individuals have usually thought of social payoffs when making investments, although they’ve differed on the social outcomes that they search, and the diploma to which they’re prepared to sacrifice the underside line to realize these outcomes.

Within the final twenty years, this age-old investing conduct has come beneath the umbrella of impression investing, with a number of books on the way to do it proper, tutorial analysis on how it’s working (or not), and organizations devoted to advancing its mission. The International Affect Investing Community (GIIN), a non-profit that tracks the expansion of this investing motion, estimated that greater than $1.16 trillion was invested by impression traders in 2021, with a various vary of traders:

| International Affect Investing Community, 2022 Report |

Not surprisingly, the steadiness between social impression and monetary return desired by traders, varies throughout investor teams, with some extra targeted on the previous and others the latter. In a survey of impression traders, GIIN elicited these responses on what forms of returns traders anticipated to earn on their impression investments, damaged down by teams:

|

| International Affect Investing Community, 2020 Report |

Nearly two thirds of impression traders consider that they will eat their cake and have it too, anticipating to earn as a lot or greater than a risk-adjusted return, at the same time as they do good. That delusion working deepest amongst pension funds, insurance coverage firms, for-profit fund managers and diversified monetary traders, who additionally occur to account for 78% of all impression investing funds.

If having a optimistic impression on society, whereas incomes monetary returns, is what characterizes impression investing, it might take one among three varieties:

- Inclusionary Affect Investing: On the inclusionary path, impression traders hunt down companies or firms which can be most certainly to have a optimistic impression on no matter societal downside they’re searching for to unravel, and spend money on these firms, usually prepared to pay increased costs than justified by the monetary payoffs on the enterprise.

- Exclusionary Affect Investing: Within the exclusionary segue, impression traders promote shares in companies that they personal, or refuse to purchase shares in these companies, if they’re seen as worsening the focused societal downside.

- Evangelist Affect Investing: Within the activist variant, impression traders purchase stakes in companies that they view as contributing to the societal downside, after which use that possession stake to push for modifications in operations and conduct, to scale back the detrimental social or environmental impression.

The impact of impression investing within the inclusionary and exclusionary paths is via the inventory value, with the shopping for (promoting) in inclusionary (exclusionary) investing pushing inventory costs up (down), which, in flip, decreases (will increase) the prices of fairness and capital at these companies. The modifications in prices of funding then present up in investing choices and progress selections at these firms, with good firms increasing and unhealthy firms shrinking.

With evangelist impression investing, impression traders intention to get a crucial mass of shareholders as allies in pushing for modifications in how firms function, shifting the corporate away from actions that create unhealthy penalties for society to those who have impartial or good penalties.

As you possibly can see, for impression investing to have an effect on society, a sequence of hyperlinks need to work, and if all or any of them fail, there may be the very actual potential that impression investing can have perverse penalties.

- With inclusionary investing, there may be the hazard that you simply mis-identify the businesses able to doing good, and flood these firms with an excessive amount of capital. Not solely is capital invested in these firms wasted, however will increase the boundaries to higher alternate options to doing good.

- With exclusionary investing, pushing costs down under their “honest” values will allow traders who don’t care about impression to earn increased returns, from proudly owning these firms. Extra importantly, if it really works at lowering funding from public firms in a “unhealthy” enterprise, it would open the door to personal traders to fill the enterprise void.

- With evangelist investing, an absence of allies amongst different shareholders will imply that your makes an attempt to vary the course of companies shall be largely unsuccessful. Even when you’re profitable in dissuading these firms from “unhealthy” investments, however could not have the ability to cease them from returning the money to shareholders as dividends and buybacks, slightly than making “good” investments.

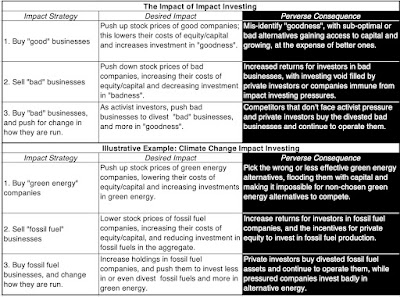

Within the desk under, I take a look at the potential for perverse outcomes beneath every of three impression investing approaches, utilizing local weather change impression investing as my illustrative instance:

The query of whether or not impression investing has helpful or perverse results is an empirical query, not a theoretical one, since your assumptions about market depth, investor conduct and enterprise responses can lead you to totally different conclusion.

It’s price noting that impression investing could haven’t any impact on inventory costs or on company conduct, both as a result of there is just too little cash behind it, or as a result of there may be offsetting investing within the different path. In these circumstances, impression investing is much less about impacting society and extra about assuaging the guilt and cleaning the consciences of the impression traders, and the one actual impression shall be on the returns that they earn on their portfolios.

The Affect of Affect Investing: Local weather Change

Whereas impression investing could be directed at any of society’s ills, it’s plain that its largest focus in recent times has been on local weather change, with a whole bunch of billions of {dollars} directed at reversing its results. Local weather change, in some ways, can also be tailor-made to impression investing, since considerations about local weather change are extensively held and most of the companies which can be seen nearly as good or unhealthy, from a local weather change perspective, are publicly traded. As an empirical query, it’s price inspecting how impression investing has affected the market perceptions and pricing of inexperienced vitality and fossil gasoline firms, the working choices at these firms, and most critically, on the how we produce and eat vitality.

Fund Flows

The largest successes of local weather change impression investing have been on the funding facet. Not solely has impression investing directed giant quantities of capital in direction of inexperienced and various vitality investments, however the motion has additionally succeeded in convincing many fund managers and endowments to divest themselves of their investments in fossil gasoline firms.

- As considerations about local weather change have risen, the cash invested in various vitality firms has expanded, with $5.4 trillion cumulatively invested within the final decade:

|

| Supply: BloombergNEF |

Nearly half of this funding in various vitality sources has been in renewable vitality, with electrified transport and electrified warmth accounting for a big portion of the remaining investments.

- On the divestment facet, the drumbeat towards fossil gasoline investing has had an impact, with many funding fund managers and endowments becoming a member of the divestiture motion:

By 2023, near 1600 establishments, with greater than $40 trillion of funds beneath their administration, had introduced or concluded their divestitures of investments in fossil gasoline firms.

If impression investing had been measured completely on fund flows into inexperienced vitality firms and out of fossil gasoline firms, it has clearly succeeded.

Market Value (and Capitalization)

It’s plain that fund flows into or out of firms impacts their inventory costs, and if the numbers within the final part are even near actuality, you need to have anticipated to see a surge in market costs at various vitality firms, because of funds flowing into them, and a decline in market costs of fossil gasoline firms, as fossil gasoline divestment gathers steam.

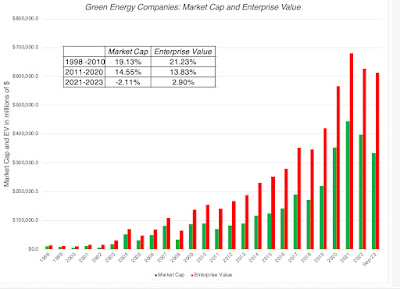

- On the choice vitality entrance, as cash has flowed into these firms, there was a surge in enterprise worth (fairness and web debt) and market capitalization (fairness worth); I report each as a result of impression investing also can take the type of inexperienced bonds, or debt, at these firms. The enterprise worth of publicly traded various vitality firms has risen from near zero twenty years in the past to greater than $700 billion in 2020, earlier than dropping steam within the final three years:

Including within the worth of personal firms and start-ups on this area would undoubtedly push up the quantity additional.

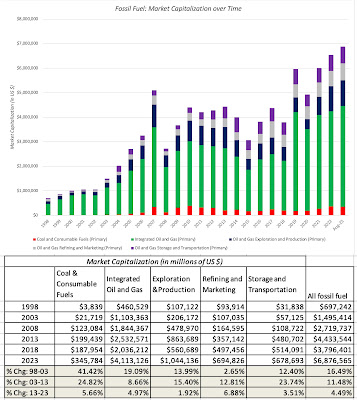

- On the fossil gasoline entrance, the fossil gasoline divestments have had an impression on market capitalizations, although there are indicators that the impact is weakening:

Within the final decade, when fossil gasoline divestment surged, the proportion modifications in market capitalization at fossil gasoline firms lagged returns available on the market, with fossil gasoline firms reporting a compounded annual share improve of 4.49% a yr.. The detrimental impact was strongest in the midst of the final decade, however market costs for fossil gasoline firms have recovered strongly between 2020 and 2023.

It’s price noting that even after their surge in market cap within the final decade, various vitality firms have a cumulated enterprise worth of about $600 billion in September 2023, a fraction of the $8.5 trillion of cumulated enterprise worth at fossil gasoline firms.

Investor perceptions

Affect investing has at all times been about altering investor perceptions of vitality firms, extra than simply costs. In truth, some impression traders have argued that their presence available in the market and advocacy for various vitality has led traders to vary their views about fossil gasoline firms, shifting from viewing them as worthwhile, cash-rich companies with prolonged lives, to firms residing on borrowed time, taking a look at decline and even demise. In intrinsic valuation phrases, that shift ought to present up within the pricing, with decrease worth connected to the latter situation than the previous:

On the inexperienced vitality entrance, to see if traders perceptions of those firms have modified, I take a look at two the pricing metrics for inexperienced vitality firms – the enterprise worth to EBITDA and enterprise worth to income multiples:

The numbers provide a blended message on whether or not impression investing has modified investor perceptions, with EV to EBITDA multiples staying unchanged, between the 1998-2010 and 2011-2023 time durations, however EV as a a number of of revenues hovering from 2.62 within the 1998-2010 time interval to five.95 within the 2011-2023 time interval. The fund flows into inexperienced vitality are affecting pricing, although it stays an open query as as to whether the pricing is getting too wealthy, as an excessive amount of cash chases too few alternatives.

fossil gasoline companies, the poor efficiency within the final decade appears to assist the notion that impression investing has modified how traders understand fossil gasoline firms, however there are some checks that must be run to come back that conclusion.

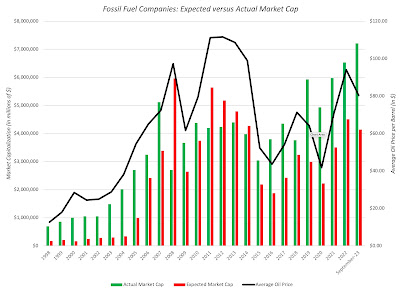

- Oil Value Impact: The market capitalization of oil firms depends on oil costs, as you possibly can see within the determine under, the place the collective market capitalization of fossil gasoline firms is graphed towards the typical oil value every year from 1970 to 2022; nearly 70% of the variation in market capitalization over time defined by oil value actions.

To separate impression investing divestment results from oil value results, I estimated the anticipated market capitalization of fossil gasoline firms, given the oil value every year, utilizing the statistical relationship between market cap and oil costs within the twenty 5 years main into the forecast yr. (I regress market capitalization towards common oil value from 1973 to 1997 to estimate the anticipated market cap in 1998, given the oil value in 1998, and so forth, for yearly from 1998 to 2023. Word that the one factor you possibly can learn these regressions is that market capitalization and oil costs transfer collectively, and that there isn’t a method to attract conclusions about causation):

If divestitures are having a scientific impact on how markets are pricing fossil gasoline firms, you need to count on to see the precise market capitalizations trailing the anticipated market capitalization, primarily based on the oil value. That appears to be the case, albeit marginally, between 2011 and 2014, however not since then. In brief, the divestiture impact on fossil gasoline firms has light over time, with different traders stepping in and shopping for shares of their firms, drawn by their earnings energy.

- Pricing: If impression investing is altering investor perceptions concerning the future progress and termination threat at fossil gasoline firms, it ought to present up in how these firms are priced, reducing the multiples of revenues or earnings that traders are prepared to pay. Within the chart under, I take a look at the pricing of fossil gasoline firms over time, utilizing EV to gross sales and EV to EBITDA as pricing metrics:

Whereas the pricing metrics swing from yr to yr, that has at all times been true at oil firms, since earnings and revenues fluctuate, with oil costs. Nevertheless, if impression investing is having a scientific impact on how traders are pricing firms, there may be little proof of that on this chart.

In sum, whereas it’s doable to seek out particular person traders who’ve turn out to be skeptical concerning the future for fossil gasoline firms, that view just isn’t reflective of the market consensus. I do consider that traders are pricing fossil gasoline firms now, with the expectation of a lot decrease progress sooner or later, than they used to, however that’s coming as a lot from these firms returning extra of their earnings as money and reinvesting lower than they used to, as it’s from an expectation that the times of fossil gasoline are numbered. Some impression traders will argue that it is because traders are short-term, however that could be a double-edged sword, because it undercuts the very thought of utilizing investing because the automobile to create social and environmental change.

Working Affect

Affect investing, along with affecting pricing of inexperienced vitality and fossil gasoline firms, also can affect how fossil gasoline firms carry out and function. On the profitability entrance, fossil gasoline firms appear to have weathered the onslaught of local weather change critics, with revenues and revenue margins (EBITDA and working) bouncing bacok from a stoop between 2014 and 2018 to achieve historic highs in 2022.

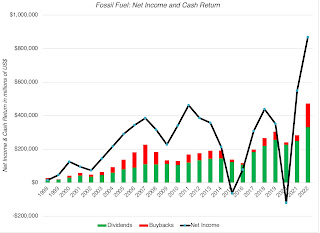

A key growth over the past decade, as earnings have returned, is that fossil gasoline firms are returning a lot of money flows that they’re producing to their shareholders within the type of dividends and buybacks, however the stress from activist impression traders that they reinvest that cash in inexperienced vitality initiatives:

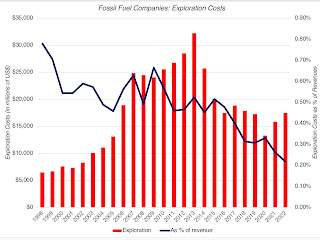

In a single growth that impression traders could welcome, fossil gasoline firms are collectively investing much less in exploration for brand new fossil gasoline reserves within the final decade than they did in prior ones:

In the event you couple this pattern of exploring much less with the divestitures of fossil gasoline reserves, over the past decade, there’s a foundation for the argument that fossil gasoline firms are lowering their fossil gasoline presence, and a few impression investing advocates could also be tempted to declare victory. In spite of everything, if the target is to scale back fossil gasoline manufacturing, does it not advance your trigger if much less cash is being spent exploring for coal, oil and fuel?

|

| Supply: Pitchbook |

Macro Affect

The success or failure of impression investing, when it pertains to local weather change, finally comes from the modifications it creates in how vitality is produce and consumed, and it’s on this entrance that the futility of the motion is most seen. Whereas various vitality sources have expanded their manufacturing, it has not been on the expense of oil consumption, which has barely budged over the past decade.

Pretty or unfairly, the pandemic appears to have carried out extra to curb oil consumption than all of impression investing’s efforts over the past decade, however the COVID impact, which noticed oil consumption drop in 2020 has largely light.

Taking a worldwide and big-picture perspective of the place we get our vitality, a comparability of vitality sources in 1971 and 2019 yields an image of how little issues have modified:

Fossil gasoline, which accounted for 86.6% of vitality manufacturing in 1971, was liable for 80.9% of manufacturing in 2019, with nearly all of that achieve from coming from nuclear vitality, which many impression traders seen as an undesirable various vitality supply for a lot of the final decade. Specializing in vitality manufacturing simply within the US, the failure of impression investing to maneuver the needle on vitality manufacturing could be seen in stark phrases:

Fossil fuels account for the next p.c of general vitality produced in the US as we speak than they did ten or fifteen years in the past, with positive aspects in photo voltaic, wind and hydropower being largely offset by reductions in nuclear vitality. If that is what passes for successful in impression investing, I might hate to see what dropping seems to be like.

I’ve tried out variants of this publish with impression investing acquaintances, and there are three broad responses that they need to its findings (and three defenses for why we should always preserve making an attempt):

- Issues can be worse with out impression investing: It’s not possible to check this hypothetical, however is it doable that our dependence on fossil fuels can be even higher, with out impression investing making a distinction? In fact, however that argument can be simpler to make, if the pattern strains had been in direction of fossil fuels earlier than impression investing, and moved away from fossil fuels after its rise. The info, although, means that the largest shift away from fossil fuels occurred many years in the past, effectively earlier than impression investing was round, primarily from the rise of nuclear vitality, and that impression investing’s tunnel imaginative and prescient on various vitality has really made issues worse.

- It takes time to create change: It’s true that the vitality enterprise is an infrastructure enterprise, requiring giant investments up entrance and lengthy gestation durations. It’s doable that the consequences of impression investing are simply not being felt but, and that they’re more likely to present up later this decade. This is able to undercut the urgency argument that impression traders have used to induce their shoppers to take a position giant quantities and doing it now, and if that they had been extra open concerning the time lag from the start, this argument would have extra credibility as we speak.

- Investing can’t offset consumption selections: If the argument is that impression investing can’t stymie local weather change by itself, with out modifications in shopper conduct, I couldn’t agree extra, however altering conduct shall be painful, each politically and economically. I might argue that impression investing, by providing the false promise of change on a budget, has really lowered the stress on politicians and rule-makers to make arduous choices on taxes and manufacturing.

Even conceding some reality in all three arguments, what I see within the knowledge is the essence of madness, the place impression traders preserve throwing in additional cash into inexperienced vitality and extra vitriol at fossil fuels, whereas the worldwide dependence on fossil fuels will increase.

Affect Investing: Investing for change

A lot of what I’ve stated about impression investing’s quest to battle local weather change could be stated concerning the different societal issues that impression traders attempt to handle. Poverty, sexism, racism and inequality have had impression investing {dollars} directed at them, albeit not on the identical scale as local weather change, however are we higher off as a society on any of those dimensions? To the response that doing one thing is healthier than being doing nothing, I urge to vary, since appearing in ways in which create perverse outcomes could be worse than sitting nonetheless. To finish this publish on a hopeful word, I consider that impression investing could be rescued, albeit in a humbler, extra modest kind.

- With your personal cash, move the sleep check: If you’re investing your personal cash, your investing ought to mirror your pocketbook in addition to your conscience. In spite of everything, traders, when selecting what to spend money on, and the way a lot, need to move the sleep test. If investing in Exxon Mobil or Altria leads you to lose sleep, due to guilt, you need to keep away from investing in these firms, regardless of how good they give the impression of being on a monetary return foundation.

- With different individuals’s cash, be clear and accountable about impression: If you’re investing different individuals’s cash, and aiming for impression, it is advisable to be express on what the issue is that you’re making an attempt to unravel, and get purchase in from those that are investing with you. As well as, you need to specify measurement metrics that you’ll use to judge whether or not you might be having the impression that you simply promised.

- Be sincere about commerce offs: When investing your personal or different individuals’s cash, it’s a must to be sincere with your self not solely concerning the impression that you’re having, however concerning the commerce offs implicit in impression investing. As somebody who teaches at NYU, I consider that NYU’s current choice to divest itself of fossil fuels won’t solely haven’t any impact on local weather change, however coming from an establishment that has established a important presence in Abu Dhabi, it’s an act of rank hypocrisy. It is usually crucial that these impression traders who count on to make risk-adjusted market returns or extra, whereas advancing social good, acknowledge that being good comes with a price.

- Much less absolutism, extra pragmatism: For these impression traders who cloak themselves in advantage, and act as in the event that they command the ethical excessive floor, simply cease! Not solely do you alienate the remainder of the world, along with your I-care-about-the-world-more-than-you angle, however you eradicate any possibilities of studying from your personal errors, and altering course, when your actions do not work.

- Harness the revenue motive: I do know that for some impression traders, the revenue motive is a grimy idea, and the basis cause for the social issues that impression investing is making an attempt to deal with. Whereas it’s true that the pursuit of earnings could underlie the issue that you’re making an attempt to unravel, the facility from harnessing the revenue motive to unravel issues is immense. Agree along with his strategies or not, Elon Musk, pushed much less by social change and extra by the will to create probably the most worthwhile firm on this planet, has carried out extra to deal with local weather change than all of impression investing put collectively.

I began this publish with two presumptions, that the social issues being addressed by impression traders are actual and that impression traders have good intentions, and if that’s certainly the case, I feel it’s time that impression traders face the reality. After 15 years, and trillions invested in its identify, impression investing, as practiced now, has made little progress on the social and environmental issues that it purports to unravel. Is it not time to attempt one thing totally different?

YouTube Video

ESG Posts