Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana continues to face mounting promoting strain because it struggles to reclaim the $150 stage, with broader market uncertainty weighing closely on value motion. Down almost 60% from its all-time excessive, Solana displays the weak point seen throughout the crypto sector, the place worry and volatility have returned to dominate investor sentiment. As macroeconomic instability and risk-off habits persist, bulls have been unable to regain management, and confidence stays shaky.

Associated Studying

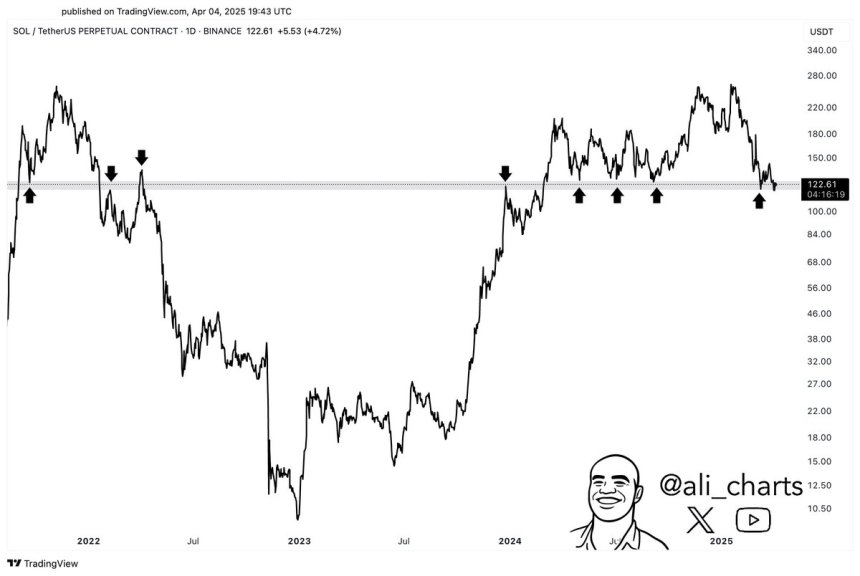

High crypto analyst Ali Martinez lately shared an necessary technical evaluation, figuring out $120 as a important make-or-break zone for Solana. In accordance with Martinez, this stage has traditionally marked main shifts in SOL’s value trajectory, usually appearing because the tipping level between restoration and additional decline. With Solana now hovering dangerously near this threshold, merchants are watching intently to see whether or not it will possibly maintain or break.

If $120 fails to behave as help, it may set off a deeper correction. On the flip aspect, holding this stage may provide bulls a base to mount a possible comeback — particularly if market situations stabilize. For now, Solana stays in a susceptible place, and the way it behaves round this key stage might outline its path within the weeks forward.

Solana Holds Important Demand As World Commerce Conflict Tensions Develop

Solana is buying and selling at a important demand zone as promoting strain intensifies throughout the crypto market, pushed by escalating international tensions and commerce warfare fears. On Liberation Day, US President Donald Trump introduced sweeping new tariffs, sparking robust responses from main economies like China. The fallout has shaken investor confidence throughout all markets, together with crypto, the place threat belongings are feeling the load of heightened uncertainty and diminished urge for food.

Solana (SOL) has been particularly susceptible, with value motion slipping towards key help ranges. Analysts warn that if present demand fails to carry, the downtrend may speed up. The following few days shall be essential, as continued weak point into subsequent week may verify a bearish breakdown. Many merchants are already making ready for extra draw back if the market doesn’t stabilize quickly.

Martinez lately highlighted the significance of the present help zone. In accordance with his evaluation, the $120 stage is a decisive make-or-break level for Solana. This zone has traditionally marked main pattern reversals and shifts in momentum. A failure to carry above it may result in a deeper correction, whereas a bounce from this stage may spark a restoration.

With SOL already 60% down from its all-time highs, bulls are on the defensive. If they’ll defend $120, there’s nonetheless hope for a reversal — however shedding it might sign that the broader bearish pattern stays intact. Within the days forward, all eyes shall be on Solana’s potential to carry the road as macro strain continues to form the crypto market’s path.

Associated Studying

Key Weekly Help Faces Breakdown Danger

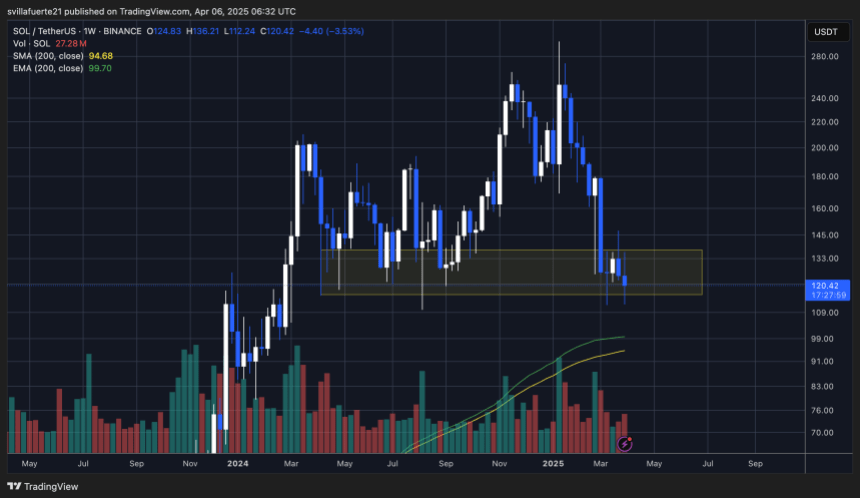

Solana is at the moment buying and selling at $120, on monitor to report its lowest weekly shut since February 2024. After weeks of promoting strain and repeated rejections under the $150 stage, bulls are working out of time to defend key help. The lack to reclaim $150 — a serious resistance zone — has saved SOL trapped in a bearish construction, with momentum firmly in favor of the bears.

For any hopes of a restoration rally to take form, Solana should reclaim $150 within the coming days. That stage stays the gateway to larger demand zones and a shift in short-term pattern. Nonetheless, if value motion continues to weaken and $120 fails to carry, the following logical goal is way decrease — across the weekly 200-day MA and EMA, each converging close to $95.

Associated Studying

This may characterize a important breakdown and sure set off further draw back strain, significantly if broader market situations stay fragile. With macroeconomic uncertainty and commerce warfare tensions weighing closely on sentiment, Solana’s place seems more and more susceptible. Until bulls step in quickly, SOL could possibly be going through a deeper retracement because it exams long-term help zones not seen since late 2023.

Featured picture from Dall-E, chart from TradingView