Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) posted modest positive factors earlier in the present day, buying and selling above $87,000 for the primary time since April 1. Crypto analysts now counsel that BTC could also be on the verge of a sustained rally, as a number of key indicators are flashing bullish alerts.

Bitcoin Rally Forward? These Indicators Say Sure

In response to a CryptoQuant Quicktake publish revealed in the present day, BTC is displaying a number of short-term bullish alerts, fuelling optimism {that a} breakout above $90,000 could possibly be imminent.

Associated Studying

Of their evaluation, CryptoQuant contributor EgyHash highlighted two key indicators that trace at bullish reversal for the apex cryptocurrency. First, the contributor outlined BTC’s Alternate Influx metric.

EgyHash famous that change inflows – the quantity of BTC being deposited into exchanges – have dropped considerably in current months. Since peaking at 120,000 in November 2024, the metric has seen a pointy decline, suggesting that holders are selecting to not transfer their BTC to exchanges, thereby doubtlessly decreasing promote strain.

The chart under reveals a constant drop in change inflows since November 2024, regardless of BTC’s worth positive factors in December 2024 and January 2025. As of now, change inflows sit round 9,300.

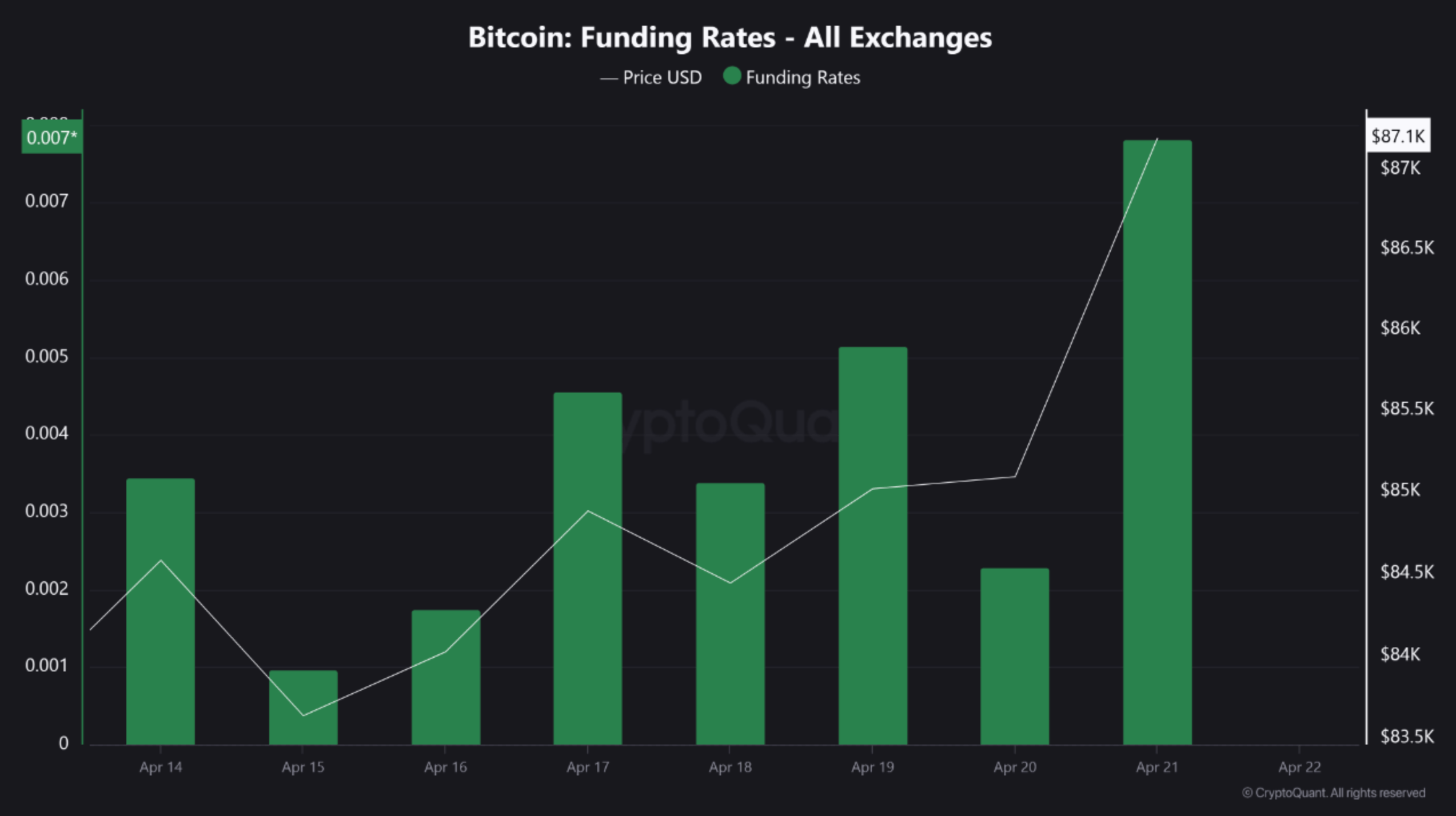

As well as, EgyHash identified that Bitcoin’s open curiosity has surged by $6 billion over the previous two weeks. This rise has been accompanied by a constructive shift in funding charges, signalling a bullish market outlook.

To clarify, an increase in open curiosity reveals that more cash is flowing into BTC futures or perpetual contracts, indicating elevated dealer participation and confidence. Equally, constructive funding charges counsel that lengthy positions – bets on BTC worth going up – are dominant, and merchants are keen to pay a premium to carry these positions.

That stated, there’s some warning to be thought-about right here. If the BTC derivatives market turns into too leveraged, then it could improve the danger of a pointy worth correction attributable to mass liquidations.

BTC Breaks Multi-Month Downtrend

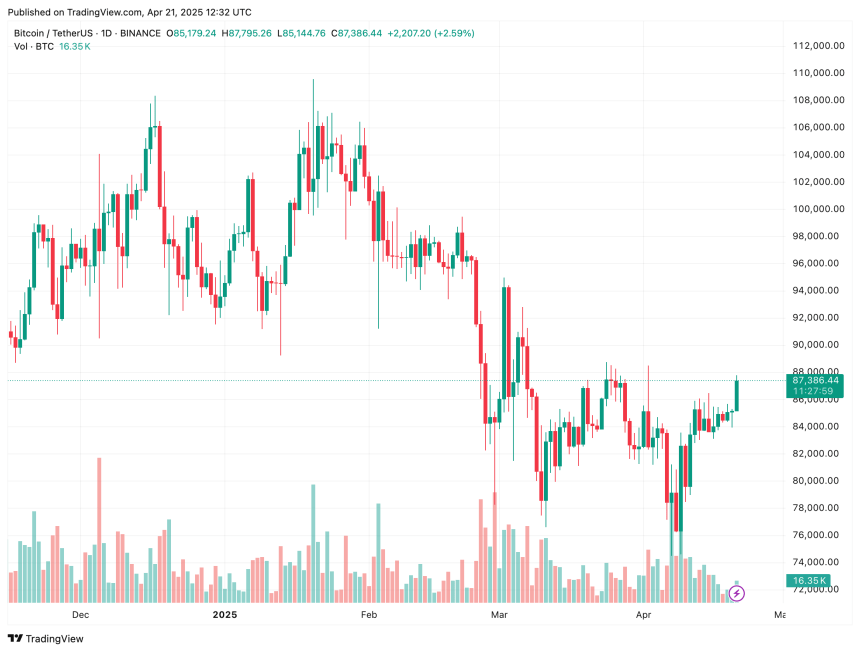

In a separate X publish, crypto analyst Rekt Capital introduced consideration to BTC breaking out of a falling wedge sample on the each day chart. Sometimes, a breakout from the falling wedge sample signifies a bullish reversal, hinting that the asset’s worth could rise after a interval of downward consolidation.

Associated Studying

Concurrently, BTC’s Relative Energy Index (RSI) is approaching the 60 stage, indicating renewed shopping for energy. That stated, if RSI nears 60 however fails to push larger, it might additionally level to weakening momentum and a possible bull entice.

Additional, BTC’s futures sentiment index is displaying indicators of warning because the metric has been on a protracted decline since February 2025. At press time, BTC trades at $87,386, up 3.4% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant, X, and TradingView.com