Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto pundit Zach Rector’s has revealed a daring projection that XRP may surge to $15 as quickly as institutional inflows pushed by exchange-traded funds (ETFs) more and more reshape market dynamics. In his evaluation, Rector contends that the anticipated inflows from XRP exchange-traded funds (ETFs) may rework the asset’s valuation panorama.

His projection is rooted in conservative assumptions and is underpinned by JPMorgan’s earlier forecasts, which steered that XRP ETFs would possibly safe between $4 billion and $8 billion in new capital throughout their first 12 months. Rector facilities his mannequin on the decrease $4 billion determine, arguing that even this modest quantity may set the stage for a dramatic market cap growth.

How Excessive Can XRP Rise With A Spot ETF?

Central to his thesis is what he phrases the “market cap multiplier.” This metric, which he describes as “the ratio of the change in an asset’s market capitalization to the online inflows it receives,” serves because the engine behind his bullish state of affairs. Rector elaborated on the idea throughout one in every of his displays: “Once you witness a short-term occasion the place XRP’s market capitalization surges dramatically with comparatively low inflows, it highlights how delicate the valuation might be to capital coming into the market.”

Associated Studying

He illustrated this with a putting instance from April 12, 2025. On that day, over the course of eight hours, XRP’s market cap elevated by $7.74 billion regardless that the online inflows had been solely $12.87 million—a phenomenon that translated into a unprecedented multiplier of 601x. “That second was a wake-up name,” Rector famous, “a transparent demonstration of how leveraged the digital asset market might be underneath the appropriate circumstances.”

Regardless of this explosive instance, Rector exercised warning by selecting a significantly extra conservative multiplier of 200x for his major evaluation. With this multiplier, the $4 billion influx assumption would generate an $800 billion enhance in market capitalization. When added to XRP’s then-current market cap of roughly $125 billion, the theoretical complete valuation climbs to almost $925 billion.

Given an estimated circulating provide of 60 billion XRP tokens, this state of affairs would end in a per-token worth near $15. “Even a conservative learn on market developments factors to a stage of appreciation that’s nothing in need of transformative,” Rector defined.

In discussing the underpinning assumptions, Rector was unequivocal in regards to the limitations of his mannequin. “Two issues that aren’t included on this equation that do play an element could be the futures market after which additionally the XRP ledger decentralized change exercise,” he said.

Associated Studying

Past the technicalities of his multiplier methodology, the broader market context lends weight to Rector’s optimistic forecast. Institutional momentum is clear, as evidenced by a surge in regulatory filings for spot XRP ETFs. 9 outstanding monetary establishments—amongst them Grayscale, VanEck, Ark Make investments, and WisdomTree—have sought approval from the US Securities and Trade Fee.

“The truth that established asset managers are stepping ahead to file for an XRP ETF is a sign in itself,” Rector commented. The SEC’s acknowledgment of those filings, coupled with the excitement across the Ripple authorized settlement, has bolstered market sentiment. “There’s a tangible sense of optimism within the air,” Rector added.

However the supportive surroundings, Rector stays measured in his outlook. He pointed to the underwhelming efficiency of Ethereum ETFs for context. Since their introduction in July 2024, Ethereum ETFs have solely attracted about $2.28 billion in inflows. “It is a reminder that even with sturdy institutional curiosity, the transition from conventional finance to digital belongings is just not at all times easy,” Rector remarked.

Worldwide developments have additional strengthened the narrative. In March 2025, Brazil took a big step by approving a spot XRP ETF, whereas the NYSE Arca not too long ago debuted Teucrium Funding Advisors’ leveraged XRP ETF. “World regulatory acceptance is essential,” Rector asserted, “and as extra jurisdictions heat as much as digital belongings, we are able to anticipate a extra vibrant and dynamic market.”

He concluded: “Whereas no forecast is foolproof, the developments we’re witnessing at the moment recommend {that a} milestone like $15 per XRP isn’t simply wishful pondering—it may very effectively be inside attain.”

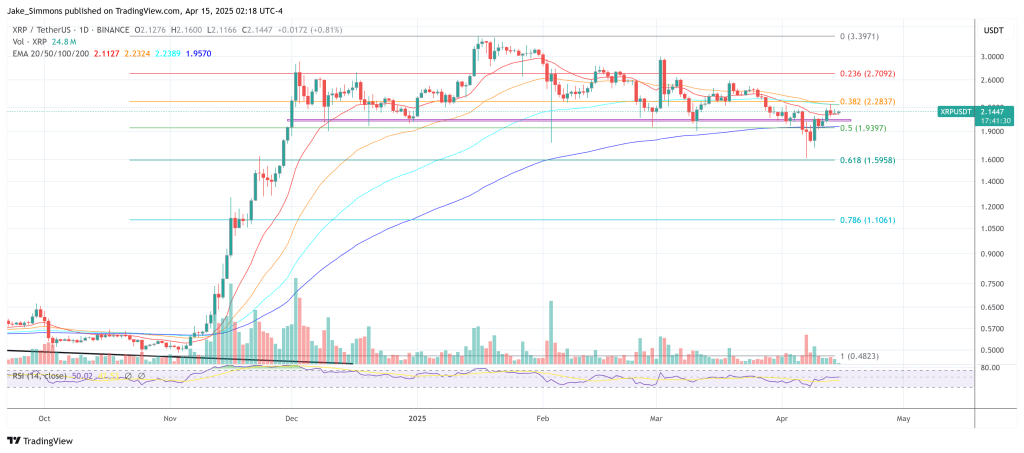

At press time, XRP traded at $2.14.

Featured picture created with DALL.E, chart from TradingView.com