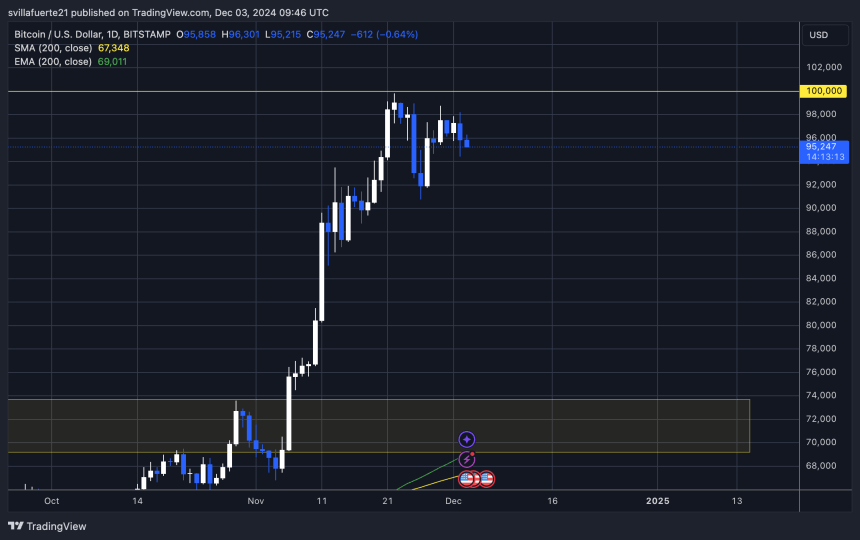

Bitcoin has entered a interval of calm after a turbulent decline from $99,000 to $90,000 over simply three days. At the moment buying and selling above $95,000, the main cryptocurrency holds a pivotal stage that may possible dictate its subsequent transfer. This key zone will decide whether or not Bitcoin regains upward momentum or seeks lower-level liquidity to determine stronger help.

Associated Studying

Regardless of the latest volatility, market individuals stay optimistic, as on-chain information gives recent insights. In response to CryptoQuant, a notable uptick in stablecoin switch volumes has coincided with Bitcoin’s value motion. This metric typically indicators elevated buying energy getting into the market, a possible precursor to renewed shopping for curiosity in Bitcoin.

As Bitcoin consolidates above $95,000, merchants and traders intently monitor its potential to reclaim psychological resistance at $100,000. Conversely, shedding help may push BTC to retest decrease ranges close to $90,000 and even deeper liquidity zones.

Bitcoin And Stablecoins: What They Have In Widespread?

Bitcoin has achieved a exceptional milestone, staying lower than 1% away from the coveted $100,000 mark, pushed by a wave of institutional and retail shopping for. This historic rally displays a rising international demand, with traders from varied nations using stablecoins to buy BTC. Stablecoins have emerged as the popular bridge, enabling seamless transactions throughout borders and currencies.

In response to CryptoQuant analyst Axel Adler, the latest surge in stablecoin switch volumes coincided with Bitcoin’s value ascent. This development highlights stablecoins’ vital function in offering liquidity and driving market momentum. Money inflows by stablecoins create sturdy help for Bitcoin’s value, permitting it to keep up upward stress even because it nears important psychological ranges.

The correlation between stablecoin exercise and Bitcoin value motion presents precious insights into market dynamics. Elevated stablecoin transfers typically sign heightened demand for Bitcoin, offering a dependable indicator of potential value actions. This interaction is especially related in figuring out durations of excessive shopping for stress, as stablecoins facilitate fast and environment friendly market participation.

Associated Studying

As Bitcoin approaches the $100,000 milestone, the continued inflow of stablecoin-driven liquidity underscores the asset’s international enchantment and resilience. Whether or not this momentum results in a breakout above $100,000 or a interval of consolidation, the function of stablecoins in fueling demand will stay pivotal in shaping Bitcoin’s value trajectory.

BTC Worth Nears Essential Zone

Bitcoin at the moment holds above the essential $95,000 stage, a value that may play a decisive function in its short-term trajectory. This stage acts as a psychological and technical help zone that might propel BTC towards the long-anticipated $100,000 milestone this week or delay the breakthrough till subsequent yr.

For Bitcoin to breach $100K, the $95,000 stage should maintain for a number of days, permitting enough time to gas demand and entice recent liquidity. Sustained shopping for stress round this vary will possible allow BTC to interrupt above the important thing psychological barrier, persevering with its historic rally.

Nonetheless, the bullish momentum faces dangers. A failure to carry the $95,000 stage would expose BTC to a retest of $92,000, one other important help. Shedding each ranges may set off a major correction, sending Bitcoin to decrease demand zones round $85,000 or sub-$ sub-$80,000. This transfer would sharply reverse its latest rally, shaking market confidence.

Associated Studying

The approaching days will probably be pivotal as merchants look ahead to sustained help above $95,000. Bitcoin’s ascent to $100,000 may quickly materialize if the bulls defend this stage successfully. In any other case, the market would possibly brace for a deeper retracement earlier than regaining its upward momentum.

Featured picture from Dall-E, chart from TradingView